Toronto, Ontario--(Newsfile Corp. - August 24, 2022) - Premium Nickel Resources Ltd. (TSXV: PNRL) (formerly, North American Nickel Inc.) ("Premium Nickel" or the "Company") is pleased to report the results of the Company's 2021 metallurgical study completed at its 100% owned Selkirk nickel-copper-cobalt- platinum group elements ("Ni-Cu-Co-PGE") sulphide Mine in Botswana.

The objective of this initial 2021 metallurgical study was to assess if readily marketable copper and nickel concentrates could be produced and, if so, at what metal recovery levels. The Selkirk test program followed a similar program conducted on samples from the Selebi Mine, which demonstrated potential for these metallurgical objectives to be achieved.

Highlights of the metallurgical study include:

- Ability to produce salable market nickel and copper concentrates

- Nickel concentrate grade of 10% nickel and 6% copper

- Copper concentrate grade of 33% copper, 0.32% nickel

- Recoveries of 63% nickel, 85% copper

- Concentrates clean of deleterious elements and with low (<1%) MgO levels

- Attractive amounts of PGE present in the concentrates

- 36.0 g/t Pd in copper concentrate

- 9.0 g/t Pd in nickel concentrate

- 36.0 g/t Pd in copper concentrate

Keith Morrison, CEO, commented: "The results from the Selkirk metallurgical studies provide important support for our re-development plan to produce separate copper and nickel-cobalt commercial concentrates. Previous non-compliant economic studies at Selkirk by Tati Nickel Mining Company, were based on the production of a low-grade concentrate that would be transported approximately 185 kilometres to the Phikwe smelter formerly operated by BCL. The closing of the BCL smelter in 2015 was a primary contributor to the closure of the parastatal Ni-Cu-Co-PGE Tati Nickel Mining Company.

This metallurgical study was an important step for PNRL to determine the potential value of the Selkirk deposit. This study also indicated the potential PGE content of the nickel and copper concentrates. We will continue to run additional metallurgical testing as the project moves forward and apply data driven best practices in all of our activities that are environmentally sound and that ultimately provide for a sustainable future."

The Selkirk Mine is situated 28 kilometres south-east of the town of Francistown, and 75 kilometres north of the Company's 100% owned Selebi Mine. The Selkirk Mine was acquired through an asset purchase agreement with the Liquidator of Tati Nickel Mining Company (see news release dated August 22, 2022). In addition to the metallurgical sampling, the company has been collecting additional information and conducting geological due diligence by examining the underground workings, reviewing mineralized drill core, collecting DGPS coordinates of drill collars and data verification of information in databases. The Company intends to include these findings in its NI 43-101 report expected to be completed by the end of 2022.

Key results of the 2021 metallurgical study are summarized below. Further details including sample preparation, methodology, technical definitions and modal analyses, as well as liberation, association and exposure characteristics can be found in the report of SGS Canada, a copy of which is available on PNRL's website. https://premiumnickelresources.ca/projects/botswana/selkirk-mine/overview/

Samples used for the 2021 metallurgical study were collected from 2016 core (HQ: 63.5mm), sawn in half, and sent to SGS Canada in Lakefield, Ontario, where each sample was analyzed for nickel, copper and sulphur for the purpose of creating the low and high-grade composite samples for metallurgical testing.

At SGS Canada, low-grade composites and high-grade composites were prepared from semi continuous intervals to represent potential open pit and underground ore types. The low grade composite had 36, ~1 metre intervals from 63.24 metre downhole to 136.37 metres while the high grade composite had 20, ~1 metre intervals from 126.67 metres to 176.67 metres. The grades of the two composites are shown in Table 1.

Table 1: Head assays for PNRL Test Program

| Element | Unit | Low-Grade Composites | High-Grade Composites |

| Cu | % | 0.55 | 0.66 |

| Ni | % | 0.44 | 0.77 |

| Ni(s) | % | 0.41 | 0.75 |

| Fe | % | 12.7 | 20.1 |

| S | % | 5.76 | 10.5 |

| Si | % | 16.3 | 13.4 |

| Au | g/t | 0.07 | 0.08 |

| Pt | g/t | 0.18 | 0.37 |

| Pd | g/t | 0.82 | 1.28 |

| Rh | g/t | < 0.02 | < 0.02 |

A subsample from each of the low-grade composite and the high-grade composite was submitted for QEMSCAN (Quantitative Evaluation of Minerals by Scanning Electron Microscopy) mineralogy at a grind size of 80% passing 129 μm and 99 μm, respectively. The major sulphide minerals were identified as chalcopyrite, pentlandite (Pn), pyrrhotite (Po), with trace amounts of pyrite. About 80-85% of the nickel was contained in pentlandite, and the remaining nickel 12-15% was mostly hosted by pyrrhotite in solid solution. Minor amounts of nickel (~3%) were hosted by non-sulphide gangue minerals. The Po:Pn ratio was ~ 10:1.

The liberation of chalcopyrite was good for both composites, with 74-83% free and liberated, but pentlandite was poorly liberated, with 46-55% free and liberated, at the grind size submitted for mineralogy. Pentlandite liberation was poor above 53 microns and very good for the - 20 micron fraction. The use of regrinding is critical to fully liberate flame pentlandite from pyrrhotite to maximize the nickel recovery and grade.

A full suite of comminution tests were conducted on the 2 composites. The Selkirk samples were confirmed to be considered hard to very hard.

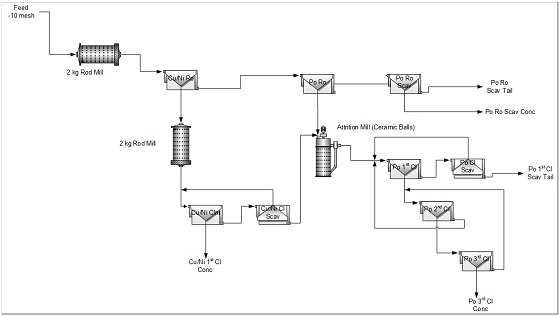

A limited number of batch tests were conducted prior to Locked Cycle Testing ("LCT") to demonstrate the process and provide a metallurgical projection for the low grade sample. The locked cycle test is a series of batch laboratory tests conducted in sequence to simulate plant results. Figures 2 and 3 shows the LCT flow sheet and Table 2 shows the test results at each stage. Figures may be viewed using the link provided with this news release.

Nickel concentrate (combined Copper Rougher Scavenger Tails and Pyrrhotite 3rd Cleaner Concentrate), having a grade of 10% nickel and containing approximately 6% copper, was achieved. The nickel recovery was reasonably good at 63%.

The recovery of copper was reasonable, achieving 55% to the copper concentrate and 85% recovery between the two concentrates. High grade copper concentrate was achieved at 33% copper. The low nickel content (0.32% nickel) in the copper concentrate was also achievable.

Attractive amounts of platinum group elements were present in the concentrates with no obvious deleterious elements. The flotation test work also demonstrated that a Pyrrhotite Rougher Scavenger Tailings with a low sulfur content (<1%) was achievable. It is notable that this was a quickly executed test program aimed at demonstrating what level of metallurgy may be possible.

Total recoveries are obtained by adding the distributions in the two concentrates.

Table 2. Combined LCT-4 and LCT-5 Results for the Selkirk Low-Grade Sample - Metallurgical Projection

| Product | Assay | ||||||

| Weight % | Cu % | Ni % | S % | Pt g/t | Pd g/t | Au g/t | |

| Cu Concentrate | 0.9 | 33.2 | 0.32 | 34.4 | 1.79 | 36.0 | 5.03 |

| Cu Ro Scav Tail | 2.3 | 5.88 | 10.3 | 33.1 | 3.65 | 7.96 | 1.59 |

| Po 3rd Cl Conc | 0.4 | 5.03 | 10.5 | 36.5 | 5.91 | 14.4 | 1.50 |

| Po 1st Cl Tails | 13.3 | 0.20 | 0.75 | 22.6 | 0.23 | 0.57 | 0.06 |

| Po Ro Scav Conc | 4.0 | 0.12 | 0.53 | 25.1 | 0.25 | 0.54 | 0.06 |

| Po Rougher Tail | 79.1 | 0.05 | 0.05 | 0.59 | 0.08 | 0.20 | 0.03 |

| Combined. Ni Concentrate (Cu Ro Scav Tails + Po 3rd Cl Conc) | 2.7 | 5.74 | 10.3 | 33.7 | 4.02 | 9.0 | 1.58 |

| Head (Calc.) | 100 | 0.49 | 0.44 | 5.72 | 0.23 | 0.83 | 0.12 |

| Product | % Distribution | ||||||

| Weight % | Cu % | Ni % | S % | Pt g/t | Pd g/t | Au g/t | |

| Cu Concentrate | 0.9 | 54.6 | 0.7 | 5.7 | 7.3 | 40.1 | 38.8 |

| Cu Ro Scav Tail | 2.3 | 27.1 | 52.2 | 13.0 | 36.1 | 21.6 | 30.0 |

| Po 3rd Cl Conc | 0.4 | 4.5 | 10.4 | 2.8 | 11.4 | 7.7 | 5.5 |

| Po 1st Cl Tails | 13.3 | 5.4 | 22.3 | 52.5 | 13.7 | 9.1 | 7.0 |

| Po Ro Scav Conc | 4.0 | 1.0 | 4.8 | 17.8 | 4.5 | 2.6 | 2.1 |

| Po Rougher Tail | 79.1 | 7.4 | 9.7 | 8.2 | 27.0 | 18.9 | 16.6 |

| Combined Ni Concentrate (Cu Ro Scav Tails + Po 3rd Cl Conc) | 2.7 | 31.6 | 62.5 | 15.8 | 47.5 | 29.3 | 35.6 |

| Head (Calc.) | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

The copper and nickel concentrates were found to be clean with little MgO (<1%) nor minor deleterious elements (i.e., As, Bi, Pb, Se, Te, Cl, F, Hg etc.) close to penalty levels. The Cu Scavenger Tail assayed 0.64% Co which is well into the payable range for Nickel concentrates. The Co level in the copper concentrate was very low at 176 g/t.

The current program was an acceptable demonstration of what the metallurgy could be for the Selkirk deposit. It is envisioned that there will be 3 to 4 more phases in metallurgical development.

Qualified Person

The scientific and technical content of this news release has been reviewed and approved by Phillip Mackey, PhD, P. Eng., Metallurgical Consultant, who is a "qualified person" for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

QA/QC

SGS Minerals Lakefield is accredited to the requirements of ISO/IEC 17025 for specific tests as listed on their scope of accreditation, including geochemical, mineralogical, and trade mineral tests. To view a list of the accredited methods, please visit the following website and search SGS Lakefield: http://palcan.scc.ca/SpecsSearch/GLSearchForm.do.

About Premium Nickel Resources Ltd.

PNRL is a Canadian company dedicated to the exploration and development of high-quality nickel-copper + cobalt resources. PNRL believes that the medium to long-term demand for these metals will continue to grow through global urbanization and the increasing replacement of internal combustion engines with electric motors. Importantly, these metals are key to a low-carbon future.

PNRL maintains a skilled team with strong financial, technical and operational expertise to take an asset from discovery to exploration to mining.

PNRL has focused its efforts on discovering world class nickel sulphide assets in jurisdictions with rule-of-law that fit a strict criteria that comply with PNRL's values and principles which stand up and surpass the highest acceptable industry standards. PNRL is committed to governance through transparent accountability and open communication within our team and our stakeholders.

On January 31, 2022, PNRL closed the acquisition of PNRL's flagship asset, the Selebi Mine. The Selebi Mine includes two shafts, (Selebi and Selebi North shafts) and related infrastructure (rail, power and water). Shaft sinking and plant construction started in 1970. Mining concluded in October 2016 when the operations were placed on care and maintenance due to a failure in the separate and offsite processing facility. The Selebi Mine was subsequently placed under liquidation in 2017.

The proposed work plan for the Selebi Mine includes diamond drilling which is expected to be ongoing for up to 18 months. During that time, additional metallurgical samples will be collected and sent for more detailed studies. The underground infrastructure at Selebi North will be upgraded to support an underground drilling program as well as improve health & safety.

In addition, PNRL is evaluating direct and indirect nickel asset acquisition opportunities globally, and also: (i) holds 100% interest in the Selkirk Mining Licence and four Prospecting Licenses in Botswana, (ii) holds a 100% interest in the Maniitsoq property in Greenland, which is a camp-scale permitted exploration project comprising 3,048 square kilometres covering numerous high-grade nickel-copper + cobalt-sulphide occurrences associated with norite and other mafic-ultramafic intrusions of the Greenland Norite Belt; (iii) holds a 100% interest in the Post Creek/Halcyon property in Sudbury, Ontario which is strategically located adjacent to the past producing Podolsky copper-nickel-precious metal sulphide deposit of KGHM International Ltd.; (iv) holds a 100% ownership of property in the Quetico region near Thunder Bay, Ontario; and (v) is expanding its area of exploration interest into Morocco.

ON BEHALF OF THE BOARD OF DIRECTORS

Keith Morrison

Chief Executive Officer

Premium Nickel Resources Ltd.

For further information about Premium Nickel Resources Ltd., please contact:

Jaclyn Ruptash

Vice President Business Development

+1 (604) 770-4334

Cautionary Note Regarding Forward-Looking Information

Certain statements contained in this news release may be considered "forward‐looking statements" within the meaning of applicable Canadian securities laws, including the ability of exploration results (including drilling) to accurately predict mineralization; the significance of the metallurgical study; the significance of PGE in the concentrate; and the business and prospects of the Company. These forward‐looking statements, by their nature, require the Company to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward‐looking statements. Forward‐looking statements are not guarantees of performance. Words such as "may", "will", "would", "could", "expect", "believe", "plan", "anticipate", "intend", "estimate", "continue", or the negative or comparable terminology, as well as terms usually used in the future and the conditional, are intended to identify forward‐looking statements. Information contained in forward‐looking statements are based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including management's perception of geology and mineralization; perceptions of historical trends, current conditions and expected future developments, current information available to the management of the Company, public disclosure from operators of the relevant mines, as well as other considerations that are believed to be appropriate in the circumstances. The Company considers its assumptions to be reasonable based on information currently available, but cautions the reader that their assumptions regarding future events, many of which are beyond the control of the Company, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect the Company and its businesses.

For additional information with respect to these and other factors and assumptions underlying the forward‐looking statements made in this news release concerning the Company, see the section entitled "Risks and Uncertainties" in the most recent management discussion and analysis of the Company, which is filed with the Canadian securities commissions and available electronically under the Company's issuer profile on SEDAR (www.sedar.com) and the risk factors outlined in the filing statement of the Company dated July 22, 2022, which are available electronically on SEDAR (www.sedar.com) under the PNRL's issuer profile. The forward‐looking statements set forth herein concerning the Company reflect management's expectations as at the date of this news release and are subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward‐looking statements, whether as a result of new information, future events or otherwise, other than as required by law.

Neither the Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Figure 2. Flowsheet used in PNRL LCT testing- production of Cu/Ni 1st Cleaner concentrate

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7759/134700_fig2en.jpg

Figure 3. Flowsheet used in PNRL LCT testing- production of nickel concentrate (Cu Ro Scav tails) and copper concentrate (Cu 3rd Cl conc)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7759/134700_fig3en.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/134700